Most of us have a certain financial aim in life. But not all have the background and means to secure those goals. For those of us who are not born with the means, loans help us to make our dreams come true.

Majorly there are two types of loans, Secured and Unsecured. The basic difference between the two types of loans is the need for collateral. A secured loan can be secured by putting up one of your worthy assets as collateral whereas an unsecured loan is given based on the borrower’s capacity to repay.

What is an Unsecured Loan?

A loan offered by the lender based solely on the creditworthiness of a borrower is an Unsecured Loan. This type of loan does not require any collateral as security, from the borrower. Personal loans, student loans, and credit cards; all fall under the category of unsecured loans.

Unsecured Vs Secured Loans

The unsecured loans carry far greater risk for the lender as compared to the secured loans; primarily due to the absence of any collateral from the borrower. Hence the higher interest rates as compared to secured loans, where an asset of the borrower covers the risk of default in payment. However, there are laws to protect the interest of the lender wherein any default in payment can be taken care of, either by a collection agency or court of law, in worse scenarios. On the other hand, there are laws to protect the borrowers from discriminatory lending practices.

Pros and Cons of Unsecured Loans

What makes you eligible for Unsecured Loans?

For procuring an unsecured loan, your financial status stands in as the collateral. The lender would do a background check of your credit score, employment history, income, and ongoing debt to assess your financial standing. Money in your savings or investment accounts, personal assets like a home or car will also contribute to your financial credibility and help you seek the desired unsecured loan.

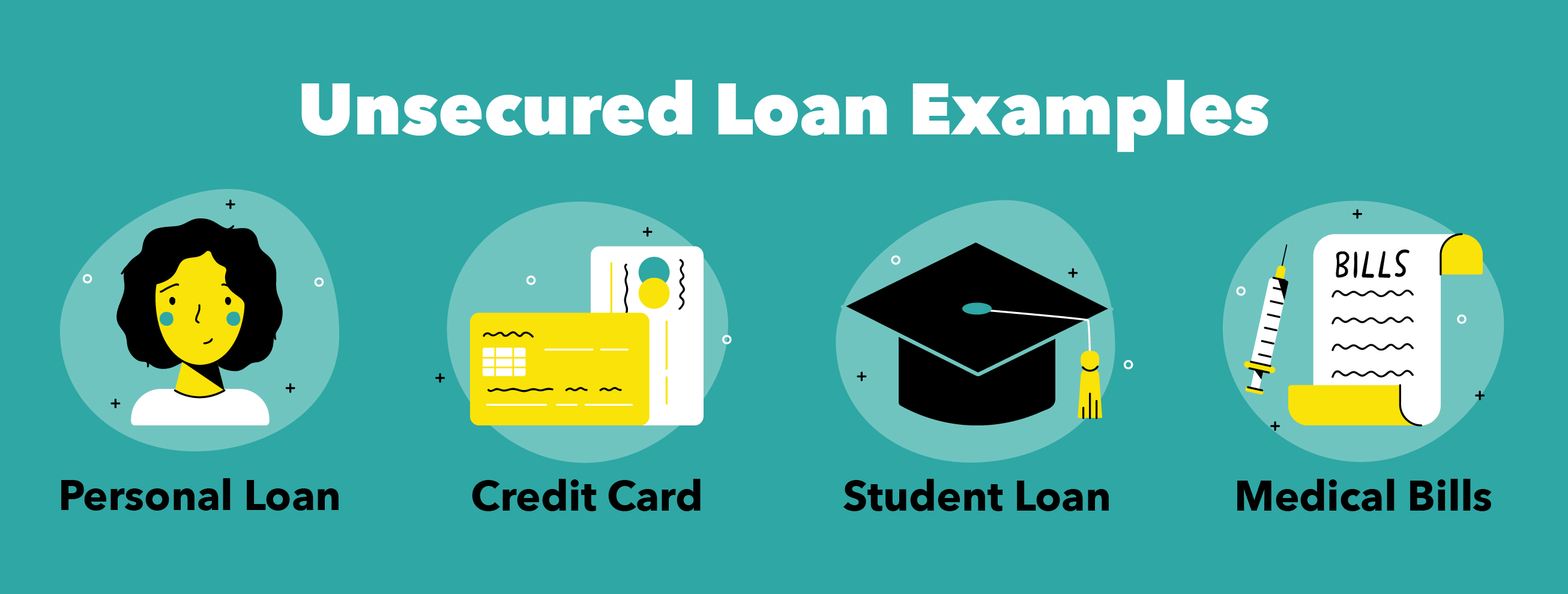

Examples of Unsecured Loans:

Credit Cards – Normally called “Plastic money”, it helps to make the expenses now and pay later. The bill is generated once a month and interest is levied for late payment or partial payments.

Personal Loans – These are multipurpose loans that can be used for home renovations, personal financial needs, medical purposes, etc.

Business Loans – Unsecured loan sought for business purposes like the expansion of business, payment of tender, etc. is called a business loan.

Education Loans – These loans are to facilitate students to pursue their desired educational courses, without worrying about the costs incurred.

General Eligibility Criteria

- A stable job ensures the capacity to repay. A regular employment record will help a customer secure an unsecured loan.

- For salaried individuals minimum of 2 years of professional service and a self-employed person, a minimum of 5 years of earning tenure is good eligibility.

- Applicants should be above 21 years and below 60 years for salaried borrowers, and between 25 and 65 years for self-employed individuals.

- Current financial statements play a crucial role in determining loan eligibility.

- Customers’ credit history is a very important factor in determining eligibility, rate of interest, and loan amount.

- The pending EMIs from other loans are also taken into consideration by the lending institution to assess your loan eligibility and amount.

Thank you for visiting our website. Stay connected with us for more knowledgeable things like this.