- info@wincapital.in

- +91 8368032788

When a lender gives money to an individual or entity with a certain guarantee or based on trust that the recipient will repay the borrowed money with certain added benefits, such as an interest rate, the process is called lending or taking a loan.A loan has three components – principal or the borrowed amount, rate of interest and tenure or duration for which the loan is availed.

A loan application procedure is complete only when the document verification is successful. Be it any type of loan, an applicant has to provide all the necessary documents as per the requirement. The importance of documents is different depending on the type of loan. In the case of unsecured loans such as personal loans, income proof, and salary slip are given the highest priority. On the other hand, for secured loans such as home loans andloan against property, property papers are of utmost importance which many people forget to maintain.

We should also keep in mind few important Factors that Lenders Look at to Approve your Application

- Credit Score :

Credit score plays an important role in deciding whether the lender would like to go ahead with your application or drop it off at the initial stage. This is especially the case when it comes to unsecured loans.Since a credit score represents the credit history of the borrower, the lender analyses the repayment history of the borrower and concludes whether the borrower can repay on time or will he default on payments. The loan approval is based on the lender’s judgement after the necessary analysis. - Income and Employment History :

:max_bytes(150000):strip_icc()/GettyImages-469191068-ac2deb35657a41e58de5bd3a2ff27c62.jpg)

Your monthly or annual income and employment history plays a crucial role in loan approval as well. Based on your income and income stability in the form of consistent and stable work history, the lender may or may not get convinced that you will be able to repay the loan.Even if you are self-employed, the lender assumes that your business is running well for the past few years and your business’s turnover is satistory.- Debt-to-Income Ratio :

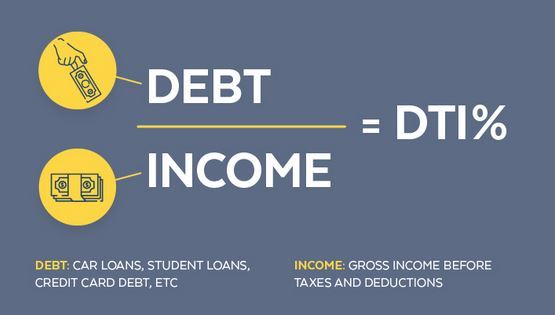

- Not just having a good income, your debt-to-income ratio is also important. In case you have an income of Rs.1 lakh per month and if your debt repayment commitments exceed Rs.75,000 already, a new loan will not be provided to you as you will need the remaining income to take care of your domestic expenses.Therefore, irrespective of your income, you must have a low debt-to-income ratio so the lenders can think that you have enough cash at hand every month to make the repayments as well as handle the family expenses.

- Collateral :Based on the collateral you provide and its current market value, the lender may decide on the interest rate applicable to your loan. Providing collateral will make the deal more secure from the lender’s perspective, which may result in more trust and less interest rate. An unsecured loan is infamous as it includes a higher interest rate comparatively.

- Down Payment :The money you have saved and the effective execution of your saving plan towards a down payment will increase the lender’s trust in you. The higher the down payment, the lower is the loan amount requirement.

Here is a list of documents that a borrower has to submit to the lender for a loan against property, personal loan, commercial vehicle loan and business loan.

For Salaried Individuals:

- Proof of Residence – Any one of Ration Card / Telephone Bill / Electricity Bill / Voters Card.

- Proof of Identity – Any one of Voters Card / Aadhaar Card/ Driver’s License / Employers Card.

- Latest Bank Statement / Passbook (where salary / income is credited for past 6 months).

- Latest 6 Months Salary Slip with all deductions and last 2 years Form 16.

- Copies of all Property Documents.

For Self-Employed Individuals:

- Certified Financial Statement for the last two years.

- Proof of Residence – Any one of Ration Card / Telephone Bill / Electricity Bill / Voters Card.

- Proof of Identity – Any one of Voters Card / Aadhaar Card/ Driver’s License / Employers Card.

- Latest Bank Statement / Passbook (where salary / income is credited for past 6 months).

- Copies of all Property Documents.

For a personal Loan the documents required are:

- Identity proof (copy of passport/voter ID card/driving license/Aadhaar)

- Address proof (copy of passport/voter ID card/driving license/Aadhaar)

- Bank statement of previous 3 months (Passbook of previous 6 months

- Latest salary slip/current dated salary certificate with the latest Form 16

- For a Business Loan the documents required are:

- PAN Card – For Company/Firm/Individual

- A copy of any of the following documents as identity proof:

- Aadhaar Card

- Passport

- Voter’s ID Card

- PAN Card

- Driving License

A copy of any of the following documents as address proof:

- Aadhaar Card

- Passport

- Voter’s ID Card

- Driving License